In the past I've written countless articles about gold (GLD) and silver (SLV), claiming they're going to be great long-term bets no matter what they currently trade for, and that they're both looking relatively cheap to purchase in 2013 after their prices fell significantly over the past few years. For months, people have informed me that I've looked like an idiot. Now it's starting to look like ole' QTR may have been onto something after all.

To reiterate, for the millionth time, let me just set the record straight on where I sit with precious metals. I come from the "old school" of Austrian economics. Austrian economics dictate that market corrections and pullbacks are good things. They represent the actual supply and demand of products and services and how they correspond to a company's valuation. This is important because the one time that precious metals always flourish is during market corrections and pullbacks. While Keynesian could be great for gold and silver as people should be realizing the bubbles that we make, what it really does is create big downtrends in the precious metals like the last few years, as people stupidly take on the attitude that "the Fed won't let anything bad happen to us".

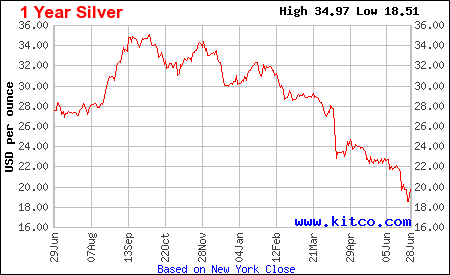

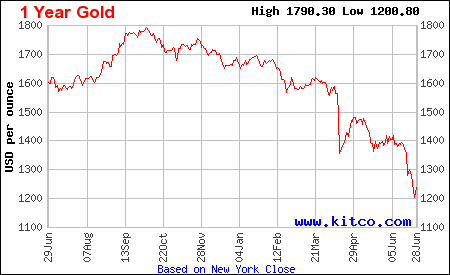

Speaking of the Fed crushing gold and silver prices, you can see how both metals have fared over the past year, through the beginning of their bullish trends that generally started heading in to the early stages of July:

Crikey! Now, let's look over the story of the past six months. From a technical perspective, there's a lot of recent bullish sentiment in the six month chart for both SLV and GLD.

(click to enlarge)

Silver has returned to over the $20 region for the first time since late June. It's showing a significant break of its previous downtrend, something that technical traders are going to like; and something that's going to ping through on a lot of automated trading screens. Gold has experienced the same type of trend reversal beginning, as you can see below.

(click to enlarge)

Now, I'm reiterating my continued bullish sentiment on both metals, as gold and silver seem primed to run again. They've been climbing like a bat out of hell over the last seven sessions preceding August 16th, with silver showing successive percentage gains that the precious metal hasn't seen in years.

The Wall Street Journal commented on Friday:

Silver settled in bull-market territory Thursday, while gold set a fresh eight-week high, as concerns about violence in Egypt and losses in equity markets led investors to buy haven assets.

Silver for September delivery, the most active contract, rose $1.148, or 5.3%, to settle at $22.935 a troy ounce on the Comex division of the New York Mercantile Exchange.

The contract is up 23.6% from its June settlement low of $18.553, placing it firmly in bull-market territory--defined as a roughly 20% rise off a recent low.

Gold for December delivery, the most active contract, rose $27.50, or 2.1%, to settle at $1,360.90 a troy ounce.

Both precious metals turned higher amid increased attention on Egypt, where a crackdown on protesters left at least 525 people dead.

President Barack Obama on Thursday condemned the violence in Egypt and cancelled plans to hold joint military exercises with the country next month.

"The Middle East is accenting the need for gold," said George Gero, a senior vice president with RBC Capital Ma! rkets Glo! bal Futures.

Mr. Gero said that the escalating violence brings with it political and economic uncertainty, and many investors in the Middle East are turning to gold in order to preserve their wealth amid these worries.

"Gold is still the ultimate haven for people who are concerned about currency values in their own countries," he said.

Gold's rally kicked into higher gear after prices breached above the $1,340 level, where many bearish investors had positioned so-called "stop loss" orders, said Bill Baruch, a senior market strategist with Chicago-based brokerage iiTrader. These automatic trades are triggered if market prices rise above a certain level and are authorized to purchase gold in order to close out bets on lower prices.

Silver's move was catalyzed not only by gold's run, but more importantly for silver, due to better outlooks for industry worldwide. Silver has the unique advantage over gold in that it is used not only to be held in reserves, but also for industry. Not only that, it's used significantly in industry, which is why news of bullish industry worldwide is something often has direct ties to silver's spot price. Additionally, both silver and gold have been benefiting from middle east unease and losses in equity markets globally.

As reported by CNBC.com, analysts are starting to get bullish on the metals as well:

Lennox said the factors that helped spur silver's rally will continue to push the metal higher this year, and said it could hit highs of $30 to $35 before the end of the year.

Furthermore, silver's dramatic rally over the past week is bound to attract investor attention and help fuel further gains, added.

"There is one good way to get yourself on the radar, and that's to have a good price rally, all the speculators pick up on it and it then become self-feeding," he added.

IG's Shamu forecasts that silver will reach $24-25 an ounce in the short term, and highs of $28 by the end of the year.

There isn't so much risk as there is a learning curve with metals. With precious metals, there's lessons to learn right off the bat. One of the first things that I found out as a novice investor was that gold stocks are much riskier than gold itself. ETFs that include gold mining companies often move with much wilder swings than the underlying commodity. Individual stocks are even riskier. It's important to remember that gold and silver business stocks can go under even when the underlying commodity does not. You have to remember that you're betting on a metal-based business when you buy the stock, not the commodity price directly.

Best Casino Stocks For 2014

I love the investing method of simply buying gold and silver bullion and holding it in your own "personal reserve". Betting on the companies comes with some added risk.

The other common way to invest is through ETFs such as iShares Gold Trust (IAU), which basically track the price of the commodity by physically purchasing bullion. The ETFs asset price reflect the price as which it trades for. If the underlying asset is silver, the ETF trades proportional to what the silver's worth.

ETFs are an incredibly easy way to trade silver and gold in the account that you already have and can be traded very quickly, unlike physical silver and gold. ETFs are a much quicker and much more convenient way to trade these metals.

Arguments against ETFs include the fact that they cannot be simply traded for the metals, they're not a great hedge against stock volatility, and there's usually a management fee associated with ETFs. Questions are often raised about the fact that ETFs don't necessarily need to disclose the actual trust holdings, in terms of how much gold they actually have in trust. If you're holdin! g physica! l, you know exactly what your personal holdings are because you can just open your eyes and take a gander whenever you please.

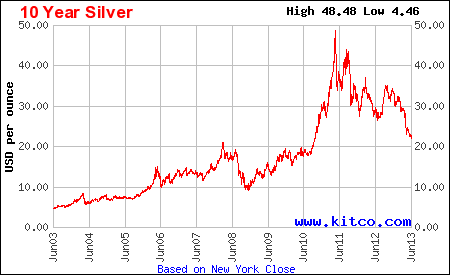

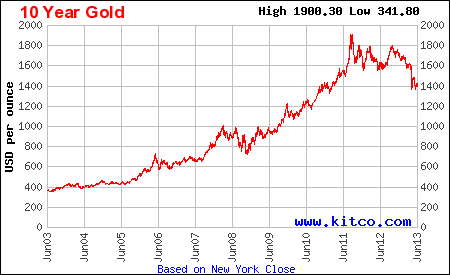

To further make my point about precious metals being good long-term investments, take a look at silver & gold's long-term charts compared to their one year charts:

The metals are both experiencing insane returns over the last 20-year period and are both arguably in the middle of a tremendous long-term bull run. There are tons of arguments out there against gold and silver, as you may have noticed over the past couple of years, but in the long term, as long as we are not heading back to the gold standard, both metals will rise in value correlating with inflation.

On the spurs of this rally beginning again, I continue to remain bullish on gold and silver going forward, for the foreseeable future and wish all traders the best of luck.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Getty Images

Getty Images  “The new platform consolidates a household’s financial information into one place, making it easier for both the client and his or her financial advisor to see the complete picture, as well as analyze budgets, investments and retirement projections,” said Christina Hurley (left), head of products for ING U.S. Retirement Solutions Individual Markets, in a press release on Wednesday.

“The new platform consolidates a household’s financial information into one place, making it easier for both the client and his or her financial advisor to see the complete picture, as well as analyze budgets, investments and retirement projections,” said Christina Hurley (left), head of products for ING U.S. Retirement Solutions Individual Markets, in a press release on Wednesday.