NEW YORK (TheStreet) -- CHANGE IN RATINGS

Advisory Board (ABCO) was intitiated with a buy rating at Bank of America/Merrill Lynch. $67 price target. Company can deliver solid growth and deserves a premium valuation.

Aetna (AET) was upgraded at Bank of America/Merrill Lynch to buy from neutral. Valuation call, based on a $79 price target, BofA/Merrill said.

Axiall (AXLL) was downgraded at BofA/Merrill to neutral from buy. $45 price target. Company lacks near-term catalysts, BofA/Merrill said. Brady (BRC) was downgraded at Robert Baird to neutral from outperform. $33 price target. WPS segment will likely grow faster than expected, Robert Baird said. [Read: August Retail Sales Disappoint] Dominion Resources (D) was upgraded at J.P. Morgan to overweight from neutral. $68 price target. Midstream growth and the formation of an MLP next year will unlock value from the existing assets, J.P. Morgan said. Finish Line (FINL) was upgraded at Piper Jaffray to neutral from underweight. $21 price target. Comps are easing and the Macy's initiative will likely be positive, Piper Jaffray said. Intel (INTC) was upgraded at Jefferies to buy from hold. $30 price target. Focusing its manufacturing leadership to make MPUs that are lower power, higher performance and cheaper, Jefferies said. NTELOS (NTLS) was downgraded to hold at TheStreet Ratings. [Read: iPhone 5c Pre-Orders Go Live] Pinnacle West Capital (PNW) was upgraded to neutral from sell at Citigroup. A key overhang related to the deregulation of the retail electric market in Arizona was removed, said Citigroup. Price target is $57. QEP Resources (QEP) was downgraded at Deutsche Bank to hold. $34 price target. Valuation call, as the stock has outperformed its peers by 28% year to date, Deutsche Bank said. Teva Pharmaceuticals (TEVA) was downgraded at J.P. Morgan to neutral from overweight. $43 price target. Recovery is likely to be a gradual one with need to rebuild pipeline in the face of an eroding Copaxone franchise, J.P. Morgan said. Under Armour (UA) was downgraded at DA Davidson to neutral from buy. $85 price target. Valuation call, as the stock is up 65% year-to-date, DA Davidson said. Urban Outfitters (UA) was initiated with a buy rating at Sterne Agee. $45 price target. Bar has been reset and the company offers a compelling growth story, Sterne Agee said.

Top 10 Cheap Stocks For 2014: Uranium Resources Inc.(URRE)

Uranium Resources, Inc. engages in the acquisition, exploration, development, and mining of uranium properties, using the in situ recovery or solution mining process. It owns developed and undeveloped uranium properties in South Texas; and undeveloped uranium properties in New Mexico. The company?s primary customers include utilities who utilize nuclear power to generate electricity. Uranium Resources, Inc. was founded in 1977 and is based in Lewisville, Texas.

Advisors' Opinion: - [By John Udovich]

Since the start of the week, small cap nuclear fuel stock USEC Inc (NYSE: USU) more than doubled for investors, something that has not happened for investors in uranium stocks like Uranium Resources, Inc (NASDAQ: URRE), Denison Mines Corp (NYSEMKT: DNN), Ur-Energy Inc. (NYSEMKT: URG) and Uranerz Energy Corp (NYSEMKT: URZ). To recap: USEC Inc closed at the $6 level on Friday, but then it surged to the $15 level on Monday only to open at the $10 level on Tuesday when it ultimately closed at $12.46. So what in the world is going on with USEC Inc and is it time to revisit nuclear fuel and uranium stocks?

Top 10 Cheap Stocks For 2014: Popular Inc.(BPOP)

Popular, Inc., through its subsidiaries, provides a range of retail and commercial banking products and services primarily to corporate clients, small and middle size businesses, and retail clients in Puerto Rico and Mainland United States. It offers deposit products; commercial, consumer, and mortgage loans, as well as lease finance; and finance and advisory services. The company also offers trust and asset management, brokerage and investment banking, and insurance and reinsurance services. As of December 31, 2010, it owned and occupied approximately 94 branch premises and other facilities in Puerto Rico; and 119 offices, including 20 owned and 99 leased in New York, Illinois, New Jersey, California, Florida, and Texas. Popular, Inc. was founded in 1917 and is headquartered in San Juan, Puerto Rico.

Advisors' Opinion: - [By Jake L'Ecuyer]

Popular (NASDAQ: BPOP) shares tumbled 5.54 percent to $27.48 after Morgan Stanley downgraded the stock from Equal-weight to Underweight.

Pacific Coast Oil Trust (NYSE: ROYT) down, falling 7.13 percent to $16.70 after the company priced a public offering by Pacific Coast Energy Company LP and other selling unitholders of 13,500,000 trust units at a price of $17.10 per unit.

Horizon Lines, Inc., through its subsidiaries, provides container shipping and integrated logistics services. It ships a range of consumer and industrial items, such as refrigerated and non-refrigerated foodstuffs, household goods, auto parts, building materials, and other materials used in manufacturing. The company offers container shipping services to ports within the continental United States, Puerto Rico, Alaska, Hawaii, Guam, the U.S. Virgin Islands, and Micronesia. Its integrated logistics services comprise rail, truck brokerage, warehousing, distribution, expedited logistics, and non-vessel operating common carrier operations. Horizon Lines, Inc. also offers terminal services. The company operates terminals in Alaska, Hawaii, and Puerto Rico; contracts for terminal services in seven ports in the continental United States; and the ports in Guam, Yantian, and Xiamen, China, as well as Kaohsiung, Taiwan. In addition, it offers inland transportation services. As of Dec ember 20, 2009, the company owned or leased approximately 20 vessels and 18,500 cargo containers. Horizon Lines, Inc. serves consumer and industrial products companies, as well as various agencies of the U.S. government, including the Department of Defense and the U.S. Postal Service. The company was founded in 1956 and is based in Charlotte, North Carolina.

Top 10 Cheap Stocks For 2014: LifePoint Hospitals Inc.(LPNT)

LifePoint Hospitals Inc., through its subsidiaries, operates general acute care hospitals in non-urban communities in the United States. The company?s hospitals provide a range of medical and surgical services comprising general surgery, internal medicine, obstetrics, emergency room care, radiology, oncology, diagnostic care, coronary care, rehabilitation services, and pediatric services, as well as specialized services, such as open-heart surgery, skilled nursing, psychiatric care, and neuro-surgery. Its hospitals also offer outpatient services, including one-day surgery, laboratory, x-ray, respiratory therapy, imaging, sports medicine, and lithotripsy. As of December 31, 2009, LifePoint Hospitals owned or leased 47 hospitals with a total of 5,552 licensed beds in 17 states. The company was founded in 1997 and is headquartered in Brentwood, Tennessee. Lifepoint Hospitals Inc. (NasdaqNM:LPNT) operates independently of HCA Inc. as of May 11, 1999.

Advisors' Opinion: - [By Keith Speights]

The fun wasn't just limited to the big three hospital operators. Lifepoint Hospitals (NASDAQ: LPNT ) stock jumped 5% on the CMS news, reflecting a $109 million market cap expansion. Likewise, Vanguard Health Systems (NYSE: VHS ) shares climbed 5%, bumping its market cap up by�$55 million.

Top 10 Cheap Stocks For 2014: Wendy's/Arby's Group Inc.(WEN)

The Wendy's Company operates as a quick-service hamburger company in the United States. The company, through its subsidiary, Wendy's International, Inc., operates as a franchisor of the Wendy's restaurant system. As of December 26, 2011, the Wendy's system comprised approximately 6,500 franchise and company restaurants in the United States and the United States territories, as well as in 26 other countries worldwide. The company was formerly known as Wendy's/Arby's Group, Inc. and changed its name to The Wendy's Company in July 2011. The Wendy's Company was founded in 1884 and is headquartered in Dublin, Ohio.

Advisors' Opinion: - [By Chad Fraser]

Nearly four years later, the call has paid off nicely, with Tim’s shares rising 104.0% since that article was released. The company has also paid a dividend since it was spun off by Wendy’s (NYSE: WEN) in 2006 and has raised its payout every year since 2008. It currently yields 1.76%.

- [By Tamara Rutter]

Breakfast is big business for fast-food chains. However, as Wendy's (NASDAQ: WEN ) recently emphasized, it's a tough business as well. It raised the white flag recently, saying it would reduce the number of locations offering breakfast to between 300 and 400, down from about 850, according to Bloomberg.

- [By Andrew Marder]

Welcome to the world of Wendy's (NASDAQ: WEN ) . The burger chain announced preliminary second-quarter results earlier this week, and investors ate them up. The stock has risen 30% in 2013, handily beating out the S&P 500. The company is sitting on about three times as much long-term debt as it has cash, and sales are sluggish. So what gives?

Top 10 Cheap Stocks For 2014: Cowen Group Inc.(COWN)

Cowen Group, Inc. is a publicly owned asset management holding company. Through its subsidiaries, the firm provides alternative investment management, investment banking, research, and sales and trading services for its clients. It manages separate client focused portfolio through its subsidiaries. Through its subsidiaries, the firm invests in equity and fixed income markets. It also invests in alternative investments markets through its subsidiaries. Cowen Group, Inc. was founded in 1994 and is based in New York, New York with additional offices in Boston, Massachusetts, Chicago, Illinois, Cleveland, Ohio, Dallas, Texas, and San Francisco, California.

Top 10 Cheap Stocks For 2014: Whole Foods Market Inc.(WFM)

Whole Foods Market, Inc. engages in the ownership and operation of natural and organic food supermarkets. The company offers produce, seafood, grocery, meat and poultry, bakery, prepared foods and catering, coffee and tea, nutritional supplements, and vitamins. It also provides specialty products, such as beer, wine, and cheese; body care and educational products, such as books; and floral, pet, and household products. As of February 9, 2011, the company operated 302 stores in the United States, Canada, and the United Kingdom. Whole Foods Market, Inc. was founded in 1978 and is headquartered in Austin, Texas.

Advisors' Opinion: Top 10 Cheap Stocks For 2014: USG Corporation(USG)

USG Corporation, through its subsidiaries, engages in the manufacture and distribution of building materials worldwide. The company offers gypsum and related products, including gypsum wallboard, joint compounds used for finishing wallboard joints, cement boards, glass mat sheathing, gypsum fiber panels, poured gypsum underlayments, ultra light panels, and various construction plaster products. Its gypsum products are used in various building applications to finish the interior walls, ceilings, and floors in residential, commercial, and institutional constructions, and repair and remodel constructions. The company also produces gypsum-based products for agricultural and industrial customers to use in various applications, including soil conditioning, road repair, fireproofing, and ceramics. In addition, it manufactures ceiling grid and acoustical ceiling tile for electrical and mechanical systems, and air distribution and maintenance applications. USG Corporation distribut es its gypsum products through specialty wallboard distributors, building materials dealers, home improvement centers and other retailers, contractors, and a network of distributors. Further, it distributes other manufacturers? gypsum wallboard, joint compound and other gypsum products, as well as drywall metal, insulation, and roofing products and accessories. The company sells its products under SHEETROCK, DUROCK, FIBEROCK, SECUROCK, LEVELROCK, RED TOP, IMPERIAL, DIAMOND, SUPREMO, AURATONE, ACOUSTONE, DONN, DX, FINELINE, CENTRICITEE, CURVATURA, and COMPASSO brands. The company was founded in 1901 and is based in Chicago, Illinois.

Advisors' Opinion: - [By Seth Jayson]

USG (NYSE: USG ) reported earnings on April 24. Here are the numbers you need to know.

The 10-second takeaway

For the quarter ended March 31 (Q1), USG missed estimates on revenues and missed estimates on earnings per share.

- [By Eric Volkman]

She also serves as chairman of the United States Steel and Carnegie Pension Fund, and on that organization's investment committee. Outside of U.S. Steel, she sits on the board of directors of USG (NYSE: USG ) and the Pennsylvania Business Council, among other entities.

Top 10 Cheap Stocks For 2014: Freeport-McMoran Copper & Gold Inc.(FCX)

Freeport-McMoRan Copper & Gold Inc. engages in the exploration, mining, and production of mineral resources. The company primarily explores for copper, gold, molybdenum, silver, and cobalt. It holds interests in various properties, located in North and South America; the Grasberg minerals district in Indonesia; and the Tenke Fungurume minerals district in the Democratic Republic of Congo. As of December 31, 2010, the company?s consolidated recoverable proven and probable reserves totaled 120.5 billion pounds of copper, 35.5 million ounces of gold, 3.39 billion pounds of molybdenum, 325.0 million ounces of silver, and 0.75 billion pounds of cobalt. The company was founded in 1987 and is headquartered in Phoenix, Arizona.

Advisors' Opinion: - [By Matt DiLallo]

Goldcorp isn't alone in cutting its capital budget amid falling metal prices. Freeport-McMoRan (NYSE: FCX ) , for example, is slashing $1.9 billion from its capital budget over the next two years so that it can maintain balance sheet flexibility in light of falling copper and gold prices. It's the same story at Teck Resources (NYSE: TCK ) , which is also reducing its capital expenditures over the next two years. Teck is cutting $150 million out of its original $2 billion capex budget. Meanwhile, the company is targeting to keep its sustaining capex to $500 million next year. These moves are to better align these companies with current market conditions, as well as to improve cash flow and strengthen balance sheets.

- [By Chandan Dubey]

I am increasingly finding myself at a loss to describe what I feel after reading the proxy of Freeport-McMoran Copper & Gold (FCX).

I started getting interested in the stock in October 2011 when the stock price dropped precipitously to $28.85. The immediate reason was Indonesian labor strike at Grasberg. There were violent fights between unionized and un-unionized workers and the mine had to be closed at the expense of loss in production. Coupled with a jittery market the stock dropped to a level not seen since Jul 2010.

- [By Matt DiLallo]

It's been a challenging year for Freeport-McMoRan (NYSE: FCX ) . The company faced a number of obstacles to its now-closed acquisitions of Plains Exploration & Production and McMoRan Exploration Company. The good news, at least if you were in favor of these transactions, is that the deals are now closed and it can move forward.

Top 10 Cheap Stocks For 2014: AeroVironment Inc.(AVAV)

AeroVironment, Inc. designs, develops, produces, and supports unmanned aircraft systems (UAS), and efficient energy systems for various industries and governmental agencies. Its UAS provide intelligence, surveillance, and reconnaissance, including real-time tactical reconnaissance, tracking, combat assessment, and geographic data to the small tactical unit or individual war fighter. The UAS wirelessly transmit critical live video and other information generated by their payload of electro-optical or infrared sensors directly to a hand-held ground control system, enabling the operator to view and capture images during the day or at night on a hand-held ground control unit. AeroVironment also provides spare equipment, alternative payload modules, batteries, chargers, repair services, and customer support for the UAS. In addition, the company produces industrial productivity and clean transportation solutions for commercial and government customers, develops potential clean t ransportation solutions, and performs contract engineering services; offers PosiCharge electric vehicle charging systems for industrial electric material handling fleets, electric vehicle charging systems for passenger and fleet vehicles, and power cycling and test systems for developers and manufacturers of plug-in electric and hybrid vehicles, as well as battery packs, electric motors, and fuel cells; and supplies power cycling and test systems to research and development organizations that focus on developing electric propulsion systems, electric generation systems, and electricity storage systems. It supplies its UAS primarily to the organizations within the United States department of defense. AeroVironment, Inc. was incorporated in 1971 and is headquartered in Monrovia, California.

Advisors' Opinion: - [By Brian Pacampara]

Based on the aggregated intelligence of 180,000-plus investors participating in Motley Fool CAPS, the Fool's free investing community, unmanned aerial vehicle specialist AeroVironment (NASDAQ: AVAV ) has earned a coveted five-star ranking.

- [By Rich Smith]

Shares of unmanned aerial vehicle specialist-cum-battery fast-charger equipment maker AeroVironment (NASDAQ: AVAV ) surged in early Wednesday trading, helped by kind words from a new investor that's just taken a substantial stake in the company.

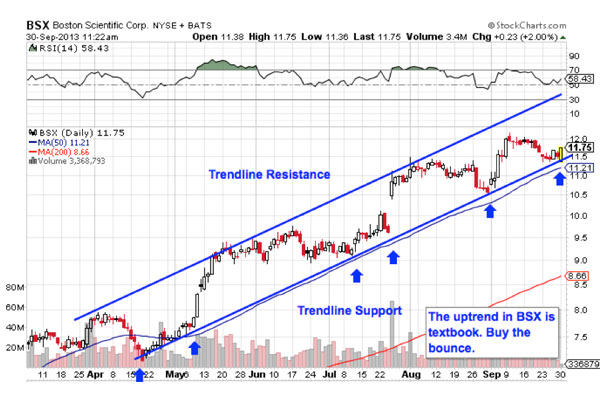

[ Enlarge Image ]

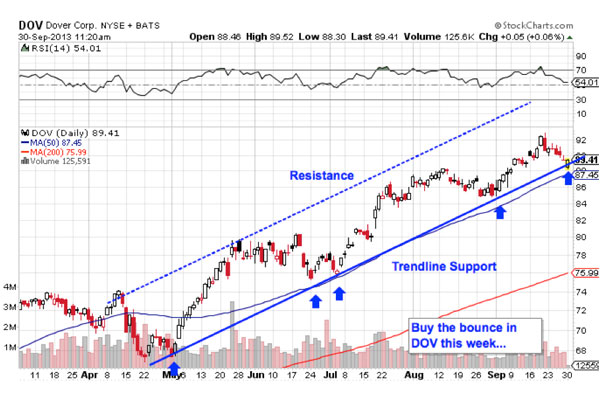

[ Enlarge Image ] [ Enlarge Image ]

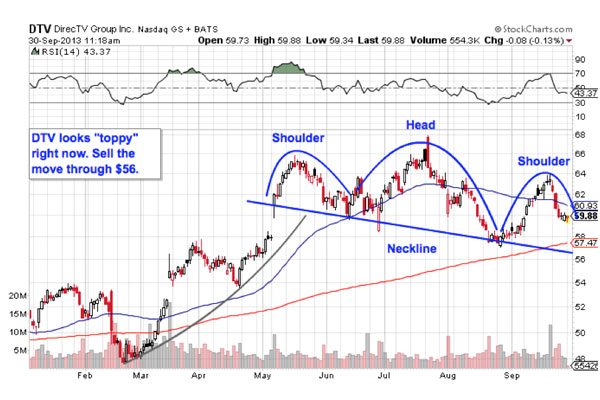

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ]

Hosted by Marketfy

Hosted by Marketfy