In recent years, the Energy Transfer franchise has been derided, abused, vilified, and scorned. Unitholders watched their investment ebb and flow (mostly flow). Nevertheless, asset-rich Energy Transfer Partners (ETP) and GP Energy Transfer Equity (ETE) maintained robust distributions throughout. Even after a strong post-earnings pop, ETP still offers an 11.7% distribution yield.

So here we stand in late May, staring at several crossroads.

Are the remainder of the major growth capital projects tracked to push the business into the Promised Land? What to make of the latest ETE / ETP rollup talk?

After a ~23% post-April uplift, are the units dear or cheap? Cash Flow: Just Win, Baby

For midstream MLPs, there are several key drivers. Coincident with unit prices as a function of cost of capital, and associated credit ratings, little matters more than cash flow. Frankly, I don't pay a great deal of attention to Energy Transfer earnings. Earnings don't pay the bills or quarterly unit distributions. Robust cash flow covers a multitude of other nagging problems.

Strong cash flow as viewed through the DCF (Distributable Cash Flow) or Operating Cash Flow lens is akin to winning.

As the late Oakland Raiders owner and GM Al Davis used to say, ��Just Win, Baby.��

ETP

Through 1Q 2018, Energy Transfer Partners recorded $1.77 billion OCF and $1.22 billion DCF. These figures blew out 2017 figures, up 29% and 90% from a year earlier. Sequential cash flow was comparable with 4Q 2017.

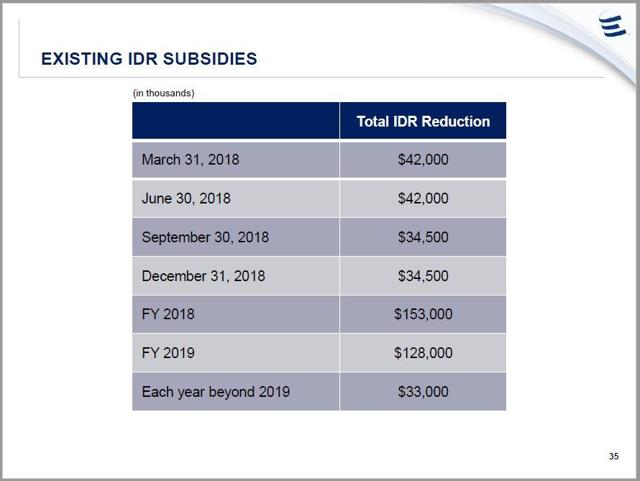

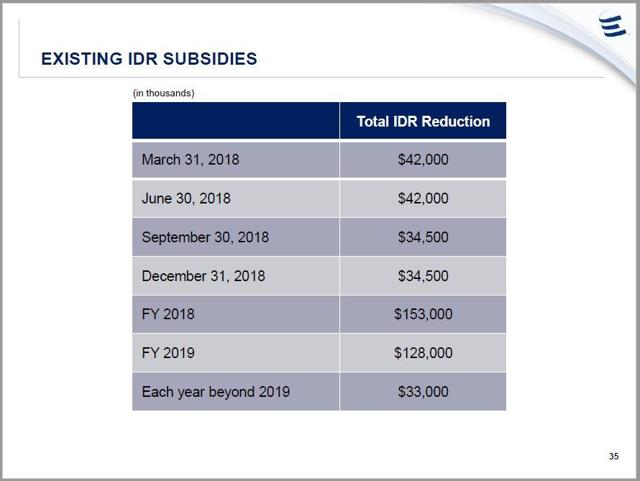

The delta cash easily permitted ETP to cover its quarterly $0.565 per unit distribution. DCF coverage ratio was a comfortable 1.15x. But this really wasn't the story line. In 2018, GP Energy Transfer Equity IDR relinquishments begin rolling off the table. Relinquishments are about a quarter of what they were a year ago. The situation continues throughout 2018 and into the out years.

Source: Energy Transfer 2018 MLP & Energy Infrastructure Conference presentation

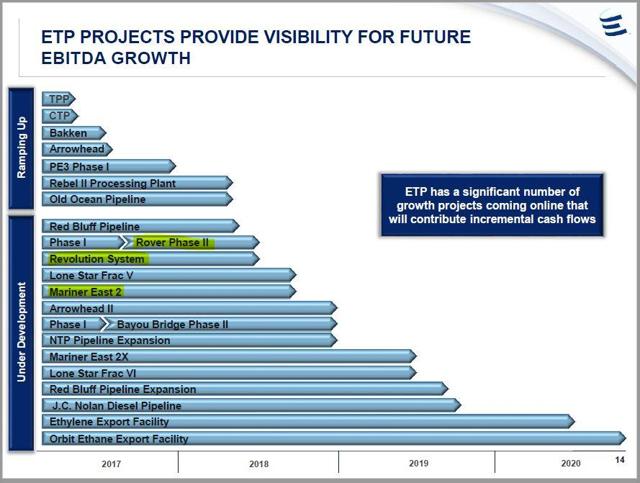

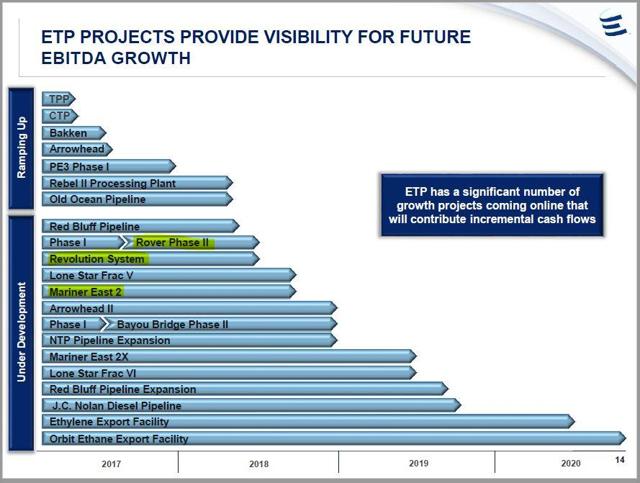

Therefore, sans a major equity offering (which I believe is unlikely), ETP can ably cover the current distribution, but there's a kicker. A number of significant major growth projects have yet to begin contributing cash.

Here's a summary of the project slate and timing schedule:

I highlighted in yellow the projects I consider to be the most critical. Last year, I forecast Rover, Revolution, and ME2 would generate ~$350 million cash flow, nearly all of it coming in the second half of 2018.

On the most recent conference call, CEO Tom Long offered his remarks about these projects.

Here's the scoop.

Rover

And last week, as I mentioned, we received approval from FERC to place additional Phase 2 facilities into service....These latest approvals by FERC allow for approximately 75% of Rover capacity to be in service.

Construction of the full project is nearing completion. All HDD crossings have been completed. And we are progressing with final hydrostatic testing and tie-in work to achieve mechanical completion and expect to ask FERC to place the rest of the 3.25 BCF per day project into service by June 1.

Revolution

Our Revolution processing plant is complete. And we expect it to go in service once Rover has received full approval of all facilities.

Mariner East 2

Now moving on to ME2....we continue to make progress on the construction of ME2, with 98% of mainline construction complete and 93% of HDDs completed or underway. At this time, we expect to place ME2 into service in the third quarter of 2018.

My model included no credit for Rebel II Processing Plant, Red Bluff Pipeline or Lone Star Frac V.

Furthermore, in 2017, I projected Energy Transfer Partners would generate $4.55 billion total DCF in 2018. This now appears too conservative. Here's some updated arithmetic:

ETP 1Q 2018 DCF = $1.22 billion x 4 quarters = $4.88 billion.

Add in $0.35 billion for new growth projects

Total 2018 DCF forecast $ 5.2 billion

Less net IDRs <2.4>billion

Less LP distributions <2.6>billion

Excess cash 0.2 billion

Indeed, the model continues to omit Rebel II and Lone Star Frac V cash flows, considering any contributions a bonus. Both projects expect to begin operating this year. Rebel II started up in April. Frac V is expected to commence operations in 3Q 2018. It's fully subscribed by long-term, fixed-fee contracts.

Meanwhile, debt leverage as measured by the banks, continues to drift lower. ETP registered a 3.89x net-debt-to-EBITDA ratio. A year ago, it was flirting with the 4.5x top-end bank limit. Notably, net debt isn't coming down. EBITDA is rising rapidly.

ETE

When Energy Transfer Partners is making money, Energy Transfer Equity is rolling in clover.

A combination of increased IDRs and reduced IDR relinquishments saw ETE improve year-over-year DCF by 83%, cover its cash distribution by 1.48x, and reduce bank leverage to 2.79x.

On the other hand, let's not forget its conversion time for the much-cursed ETE preferred, convertible offering. That deal dilutes current ETE unitholders by ~128 million units, or 12%.

ETP/ETE Rollup

Let me begin by saying there appear to be a lot of traumatized MLP investors out there. Old wounds inflicted by Kinder Morgan (NYSE:KMI) have proven to be long-lasting. My best counsel is to look forward. It's hard to drive by looking into the rear-view mirror.

While no one can predict with certainty how Energy Transfer will rollup, or even if it will rollup, Energy Transfer and Kinder Morgan are not synonymous. The entities, its management, and the business narratives are not the same.

That aside, let's begin by reviewing "rollup" earnings call comments made by CFO Tom Long and CEO Kelcy Warren. I suggest we use that as a baseline before beginning a descent into accusations of lies and conspiracy theory.

First, we know that the ratings agencies must provide the ��ticket to the ballgame.�� Here's excerpts between a Street analyst and Mr. Long:

Question:

I was wondering if we can start off with a rating agency question. Clearly, they've been the gating issue on the simplification process. I was just wondering if there's been any conversations about once the projects are fully up and running with Rover and Mariner East 2, will you be able to get trailing credit for the EBITDA that's in service, so that you can simplify earlier?

Answer:

Yes....that is probably one of the �� a very commonly asked question. And absolutely, we continue to have discussions with the rating agencies....But absolutely, answering your question very directly, we do continue to have conversations with the agencies. And we will continue to look at how we can accelerate the process.

So it sounds like management is attempting to step up the late 2019 ��rollup�� timeline.

Next, we find additional discussion around rollup entity formation between another analyst and CEO Kelcy Warren:

Question:

And then maybe just the last one as far as the structure and anything new you could say there or refresh us for your thoughts as far as how you see eventual family simplification down the future? And I guess most importantly, do you see a C-Corp as something that could really be additive to the family and open up kind of the shareholder base there?

Answer:

Yeah, this is Kelcy. I'll start with the second part of that question. We are evaluating a C-Corp structure within our partnership. We are very, very carefully evaluating that. We do not want to do something that is irreversible and something that we would regret. So that is something we are studying.

As far as the simplification that you refer to, it would most certainly be a structure whereby ETE acquires ETP. There's �� we've looked at every scenario possible to us. And we don't see any mathematical scenario that makes any sense other than that one.

Later on the call, there was another analyst exchange with Mr. Warren:

Question:

Kelcy, just back on simplification for a minute. Was it ever in the thought process of consideration, when you're thinking about evaluating a C-Corp structure in the family of companies, that you would look at ETP's depreciated asset basis. And from a taxable perspective obviously any sort of step up with ETP would create a significant amount of tax depreciation that could be amortized for many years? Or is it simply more of a partnership equity to equity swap with ETE? And there is no taxable liability coming from that simplification?

Answer:

Both. You are correct. We have looked at �� we've just every way we know to look at a C-Corp type solution for us. And we've not just said that we will not be doing that. It's just at this time, that does not appear to be the superior solution for us. So we have looked at that, to answer your first part of the question.

And of course in the next part of your question, taxes influence our decisions here. They're a very big component for our unitholders to deal with. So that is a reason that we've ended up where we've ended up. I say ended up, that's not fair. Today, if we had to make a decision today, we believe a simple purchase by ETE of ETP would be the structure. That could change by the time the rating agencies give us the green light to go forward.

So after a review of the foregoing, what do I hear?

Energy Transfer management is seeking to accelerate a rollup. By definition, this means the train is expected to be comin' through Dodge City. There is a high probability we will see an ETE / ETP rollup. Adding a C-Corp within the MLP confines is possible. I cannot speculate what that may look like, though we recall the old Williams Partners takeout model included an ETC entity. Indeed, a C-Corp rollup structure isn't off the table completely. However, if this ever comes to fruition, it will be done in a manner that will not create net / net problems for the overarching ETE/ ETP rollup concept. KW is well-aware of tax bleed. He is also the major ETE unitholder, and owns a considerable number of ETP units, too. The most likely scenario is a simple ��ETE buys out ETP.��

If the third bullet point is the final outcome, it appears to this author it will not trigger unpleasant tax consequences for either ETE or ETP unitholders. It will look comparable to the 2017 ETP / SXL deal.

[I'm not much for conspiracy, but I know many MLP investors can't help themselves. At the end of this article, there's a comment section just waiting for your input.]

What's The Fair Value of ETP/ETE Units?

Equity valuation is an exercise in handicapping probabilities, future earnings/cash flow, investor sentiment, and reversion-to-the-mean. For your consideration, I offer a few thoughts.

Using reasonable valuation ratios, ETP and ETE units look cheap.

Between 2009 and 2016, Energy Transfer Partners compiled a trimmed averaged 8x P/OCF and 9x P/DCF. In 2017, both these multiples dropped to 5x. Extrapolating 2018 results (simply multiplying 1Q results by four) yield P/OCF and P/DCF valuation multiples of 3x and 5x, respectively.

Between 2009 and 2016, investors were willing to pay 8x-9x cash flow for ETP units. It's fallen to 5x or less. ETP units trade for 3x operating cash flow, and less than 5x distributable cash flow.

Price-to-Book is in the same category.

The P/Book ratio on the units is 0.66x, and P/Tangible Book is 0.87x.

Let's try Enterprise Value-to-EBITDA.

In 2015, 2016 and 2017 EV/EBITDA was 13x, 48x, and 9x. This year, it's forecast to be 8x on a recent bid.

At an historic 8x distributable cash flow (using 4 times 1Q 2018 actual results), ETP units are worth $34. At 1.4x Tangible Book, units are worth $31. At 10x EV/EBITDA, units could be worth $33 each. At the time I wrote this article, the stock settled at $19.25.

As for GP Energy Transfer Equity, between 2009 and 2016, the trimmed average P/DCF was 19x. At year-end 2017, it was 18x. Today, on a 4Q extrapolated basis, the P/DCF is just 11x.

In 2015, 2016 and 2017, year-end EV/EBITDA (consolidated) was 17x, 23x, and 18x. This year, it's forecast to be 11x on a current bid.

At 18x this year's extrapolated DCF, ETE units have a $27 Fair Value. At 12x EV/EBITDA, an ETE unit could be worth $22.

To be clear, I'm not saying these ETP and ETE units should increase overnight by 50% or more, but the history and math says the multiples compressed drastically in 2017 and have not recovered. But the underlying business sure appears to be on a good trajectory.

Go figure. I suspect a combination of the aftermath of an energy price collapse, lack of confidence in future earnings reliability, specific business overhangs, and poor investor sentiment all have contributed to a puzzling set of Energy Transfer numbers. Pessimistic investors may arguably question the viability of the MLP business model altogether.

As observed the last time I wrote you, such compressed multiples are not aligned with the midstream MLP universe. The Alerian MLP ETF (AMLP) shows an average 1.36x P/TBV. A subset of relevant MLPs expect an average 11x EV/EBITDA on this year's forecast. Energy Transfer Partners' price-to-operating cash flow multiple resides near the very bottom of its peer group.

Please do your own careful due diligence before making any investment decision. This article is not a recommendation to buy or sell any stock. Good luck with all your 2018 investments.

Disclosure: I am/we are long ETP, ETE.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Stevens Capital Management LP lowered its holdings in shares of BRF SA (NYSE:BRFS) by 56.4% during the first quarter, HoldingsChannel reports. The firm owned 15,401 shares of the company’s stock after selling 19,929 shares during the period. Stevens Capital Management LP’s holdings in BRF were worth $107,000 as of its most recent SEC filing.

Stevens Capital Management LP lowered its holdings in shares of BRF SA (NYSE:BRFS) by 56.4% during the first quarter, HoldingsChannel reports. The firm owned 15,401 shares of the company’s stock after selling 19,929 shares during the period. Stevens Capital Management LP’s holdings in BRF were worth $107,000 as of its most recent SEC filing.

American International Group Inc. trimmed its position in Sallie Mae (NASDAQ:SLM) by 2.9% during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 867,273 shares of the credit services provider’s stock after selling 26,322 shares during the quarter. American International Group Inc. owned approximately 0.20% of Sallie Mae worth $9,722,000 at the end of the most recent quarter.

American International Group Inc. trimmed its position in Sallie Mae (NASDAQ:SLM) by 2.9% during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 867,273 shares of the credit services provider’s stock after selling 26,322 shares during the quarter. American International Group Inc. owned approximately 0.20% of Sallie Mae worth $9,722,000 at the end of the most recent quarter.